Textbooks on the Blockchain

Some good and some bad

Besides potential layoffs and earnings, it continues to be slow news during the summer.

From Bloomberg

The chief executive officer of Pearson Plc, one of the world’s largest textbook publishers, said he hopes technology like non-fungible tokens and the blockchain could help the company take a cut from secondhand sales of its materials as more books go online.

This was far from the most absurd metaverse/NFT article this week (Tinder is walking by their Metaverse plans after poor earnings, Metaverse real estate sales are tanking, etc). I actually see grains of a good idea in this one.

What’s wrong here

I see a few major issues here, starting with the framing. His job may be to grow shareholder value, but this is 100% about extracting more revenue. Textbooks play all sorts of cynical games to refresh versions and charge as much as possible. The secondhand textbook market is a frequent alternative. In the article, the CEO mourns the average of seven resales that occur after the initial sale, with Pearson seeing no cut after the first purchase. The entire narrative of crypto is to empower individuals, cut out middlemen, and lower fees. This strikes me as the opposite. Nothing about this exists for better serving the students.

In addition, digital media is highly problematic. One can argue for “ownership” of NFT art versus “right-click/save”. As many industries like newspapers and music have found out, going digital upends assumptions at the very least. With a digital version of this content and an attempt at capturing multiples more revenue, you can bet there will be digital piracy (and a cat-and-mouse game with schools/publishers to evade it).

What’s right here

As a veteran of music downloading (but now a loyal Spotify customer), the music industry is actually a great example of what can go right with digital. Music piracy nearly destroyed the industry, yet it is now in a renaissance and financial revival. At heart, the model changed from owning albums for the hits to buying the hits to subscribing to the world’s catalog of music. The customer seemingly gets a better deal, and the industry may return to former glory (on an inflation-adjusted basis).

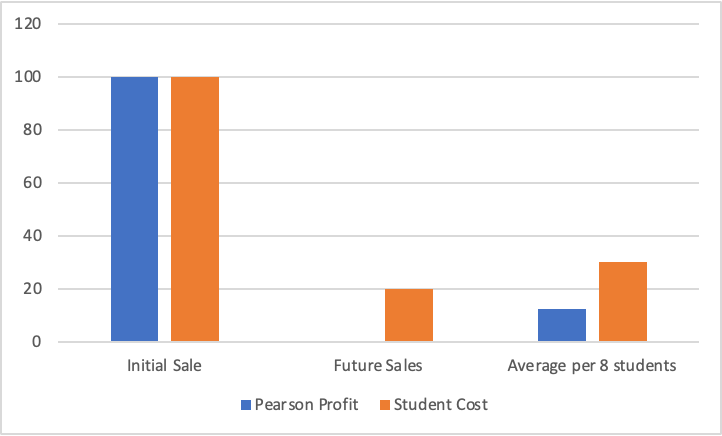

The first area of improvement is pricing. NFTs seem like pandering to the Current Thing, but there is certainly room to play with pricing. If a textbook sells for $100 upfront and $20 to the next 7 secondhand buyers, Pearson makes $12.5 per user. Students on average are willing to pay $30. Using technology to charge $20 per student generates benefits for both sides. Pearson crucially cannot drop the price of a physical text to $20 without risking resales at even lower price points.

In order for the digital NFTs of textbooks to make sense, the textbook has to be a digital experience. Even more, it can’t just be a pdf (otherwise reselling it would just be cloning it). Without the limitations of print, part of this new product offering should be a reimagining of the textbook. Software for generating endless practice problems? Feedback on your essay? Lifetime access to future updates? There are a lot of ways to use software to improve the experience (and potentially even charge a premium!).

If we are lowering the price and increasing the experience, the last area we should explore is expanding the market. At the exorbitant current price points, textbooks are a begrudging purchase. With an 80-90% price cut, the potential market should grow for many texts. I certainly have purchased a textbook or two for reference after college (for work) and would likely own more to satiate my curiosity at a different price point.

The reality

This NFT idea is better implemented as a subscription or a one-time charge to a digital hub. The current framing, usage of NFT technology, and timing mean this is unlikely to go in a productive direction.