Petal and Chime

Upstarts in banking and credit

Fintech is still red hot, and following the banking upstarts we have a wave of credit card upstarts. While these companies dream of replacing the JPMChases of the world, a better analogy for these companies is SoFi.

Petal

Petal has raised another $55MM to be “responsible credit for the modern world”. There are a few others playing here including Deserve, but I’ll focus on Petal today. Petal has two credit card offers, which illustrate the upsides and downsides of these companies. (They do look sleek, I’ll admit).

“Petal One” is the more promising of the two in my opinion. Petal one is a credit card for those who cannot otherwise get a credit card. To accomplish this, they calculate a “Cash Score” based on your bank transactions. This is a reasonable strategy – create an offering for underserved populations. With ever increasing amounts of data, Petal could plausibly be so much better at assessing risk in this population as to foreclose competition.

This is very much the SoFi play run differently. SoFi realized that in the giant morass of student loans, certain tranches were much better bets than others. SoFi has a few advantages over Petal.

Sofi is picking the prime applicants from Ivy League schools. Petal is sifting through applicants JPMChase and Wells Fargo wouldn’t touch.

Student loans are a one-off, massive transaction. Sofi can afford high customer acquisition expenses. Credit card users can be poached with higher rewards. In fact, Petal makes you more attractive to poach as Petal helps you build credit.

SoFi has a diversified portfolio of products to grow into.

Financial advertising is very costly and competitive. SoFi has a great niche, but they also succeed by trying to upsell you from a loan into a suite of products. Credit cards may be highly profitable, but I would expect these upstart companies to expand their suite of offerings very quickly.

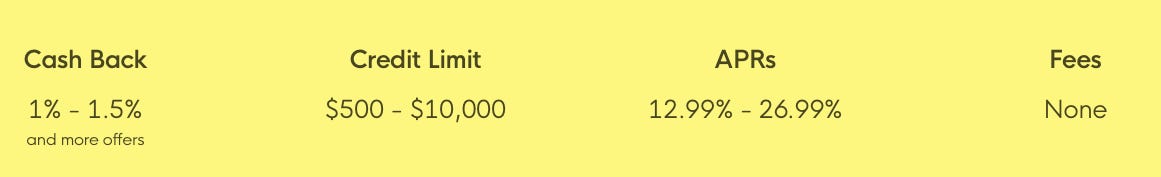

And to my point about poaching customers – look at the “Petal Two” card offering. This card is designed for individuals with good credit – i.e. other Issuers will back them. I’m not a credit card geek, but this looks pretty market rate. I don’t immediately see a reason why Petal can outcompete for users with good credit. Capital One among others ran the analytics in credit cards already.

Chime

While the credit card upstarts have a more challenging slog, the banking upstarts are seeing some real momentum during COVID.

Chime has been raising a ton of money lately. The “Neo Banks” more broadly illustrate the flip side of the “Neo Cards”. Online banks have a few key structural advantages over incumbents.

Branches – bank branches are potentially costly overhead (mortgages aside)

Product sprawl – JPMChase advertises multiple buckets of products, each with different segmentations. I see at least 7 checking accounts.

Similarly, a new bank does not necessarily need to build out less-profitable business lines.

In some ways, the best example is the “No Hidden Fees” promise. This is very reminiscent of Netlfix vs Blockbuster. Big banks make billions just in overdraft fees. Add in account service fees and other charges, and the number is surely far higher. Chime, with a different cost structure, can offer customers an experience that the major banks would struggle to profitably emulate.